ROOFING INSURANCE FAQ – ALL THE ANSWERS YOU NEED

It can be overwhelming when your roof is damaged by a storm. Dealing with insurance claim adjusters and roofers can increase that stress.

Below are answers to our key Roofing Insurance FAQs, including handling insurance after a storm.

VIDEO CASE STUDY: ROOFERS ARE CRUCIAL IN AN INSURANCE CLAIM

After inspecting the roof, we found it was significantly aged and needed a full replacement due to severe storm and wind damage. Repairs weren’t effective, so we worked with the homeowners’ insurance company to get the replacement approved.

As part of the process, the insurance required a brittle test to confirm the shingles were too old and fragile for repair. Our team conducted the test and demonstrated that replacement was the only option.

If your roof has been damaged by a storm or you’re navigating the insurance claims process, Roof MD can help. We specialize in storm damage repairs and replacements and handle communication with your insurance provider to make the process stress-free. Trust us to restore your roof and your peace of mind.

WHAT DO INSURANCE COMPANIES TYPICALLY COVER FOR ROOFING?

Homeowners insurance often only covers storm damage. This usually includes structural damage from wind, hail, fire, ice, lightning, and fallen trees. Some roofing insurance policies will cover some of these items but not others. Most roofing insurance companies only cover replacements if multiple shingles are damaged and repairs aren’t an option.

If the roof is too brittle (see the case study below) or the material is unavailable, insurance may cover a full replacement.

WHAT DO THEY NOT COVER?

Most insurance cover doesn’t include wear, tear, or bad installations. They will also not cover any damage that occurred before the policy was active or after it had expired. To avoid surprises when filing a claim, be sure to keep up with your policy’s status and updates.

WHAT ARE MY OPTIONS IF THE INSURANCE ADJUSTER UNDER EVALUATES THE WORK NEEDED?

Insurance adjusters often recommend repairs below your deductible, making a claim pointless. Your limited options may include:

- Paying for the repair out of pocket.

- Seeing if the roofer will provide a bid to compare the repair cost against the insurance deductible. If repair costs exceed the deductible, the insurance company may cover part of the expenses.

- Attempting a repair, and proving the roof cannot be repaired due to failure of a brittle test.

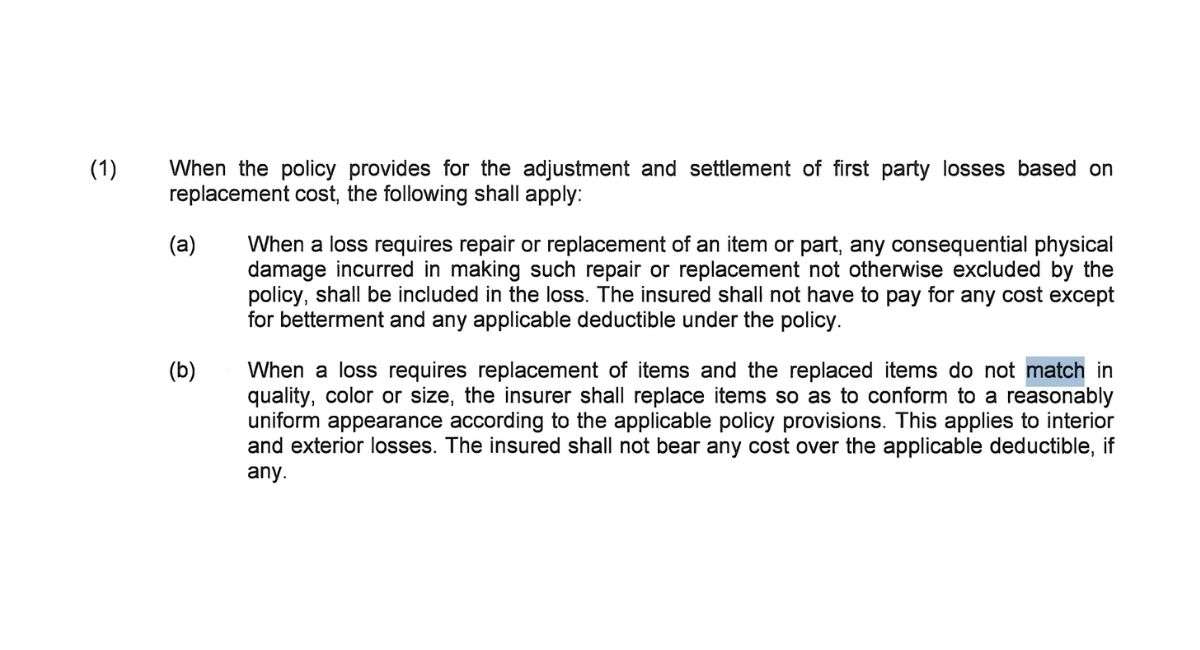

- In states with “matching laws,” insurers must pay for a full roof replacement if you can’t match the rest of the roof in quality, color, or size.

CAN I GET MY DEDUCTIBLE WAIVED ON AN INSURANCE CLAIM FOR A NEW ROOF?

Unfortunately, no.

A deductible is part of the binding contract between you and your roofing insurance provider. It’s no different than paying your deductible when you go to the doctor’s office. Not paying your deductible is considered insurance fraud and is a federal offense that can lead to heavy fines, being dropped by your insurance, and jail time.

CAN THE ROOFING COMPANY PAY MY DEDUCTIBLE AS PART OF THE OVERALL COST?

Again, no. The deductible is how much the homeowner must pay out of pocket before the insurance company will start paying for repairs or replacements. It is illegal for a roofing company to “pay the homeowner’s deductible” so don’t ask the roofer for this.

The deductible is a small price to pay for a new roof that will typically cost 10 times or more than the deductible. A good roofing company can often finance this cost if that will help.

SHOULD I SHOP FOR THE CHEAPEST PRICE IF ROOFING INSURANCE IS REPLACING IT SO I CAN POCKET SOME OF THE MONEY?

Insurance providers have made changes to combat fraud, significantly altering the pay-out process. Today, regardless of your quote or roof quality, you’re required to pay your deductible. This means a lower-cost option costs the same as a high-quality one.

Insurance companies use Xactimate, a third-party program, to calculate fair, region-specific payouts for roof replacements. Xactimate considers labor, materials, and reasonable profit for every aspect of the process. If Xactimate sets fair pricing, how can a contractor charge less without cutting corners? The answer often involves using low-quality materials, skipping essential steps, reusing damaged components, or hiring untrained, uninsured workers.

While cheaper options might seem appealing, these illegal shortcuts can lead to bigger problems down the road. Think of it this way: if you had to choose between an old Pinto and a new BMW, both with the same $500 deductible, wouldn’t you pick the better car? The same logic applies to choosing a roofer—always opt for superior quality!

WHAT IS THE IMPACT OF FILING A CLAIM?

The key to any insurance is only filing claims when you have a real need that is covered by your policy. If you file too many claims or poor-quality ones, the insurance company will either raise rates or drop coverage altogether. That’s why it’s important to have a reputable licensed roofer inspect the roof before trying to file a claim.

WHAT IS THE DIFFERENCE BETWEEN A RCV AND A ACV ROOF POLICY? WHY SHOULD I CARE?

An RCV (Replacement Cost Value) policy covers the full cost to replace your roof at today’s value, without factoring in depreciation. These are the best types of policies.

An ACV (Actual Cost Value) policy only covers the replacement cost minus depreciation based on your roof’s current condition. In ACV policies, you’ll often see “non-recoverable depreciation” listed, meaning the homeowner must pay both the deductible and depreciation out of pocket. This can be a costly surprise if you don’t have extra funds saved.

Understanding your policy before the insurance adjuster arrives can help you avoid unexpected costs.

CAN INSURANCE TELL ME WHAT CONTRACTOR TO USE FOR MY ROOF REPLACEMENT?

Never allow your insurance company to tell you which contractor to use; they only do this because it benefits them financially. They may try to convince you to pick an inexperienced contractor who is willing to work for less money, or insist that you use their recommended contractor. However, both of these situations create a conflict of interest and are illegal.

If your roofing insurance company attempts to do this or is trying to discredit the contractor that you trust and have chosen, you should file a complaint on your local state insurance commission website.

WHAT SHOULD YOU EXPECT FROM A ROOFER DURING THE PROCESS?

A contractor who acts as your advocate, handles most of the work, and communicates with your insurance can save you time and hassle when getting your claim approved and repairs completed. Here’s what a good roofing contractor should do:

- Conduct a thorough property inspection before the insurance adjuster arrives.

- Be familiar with the third-party software used by insurance companies (Xactimate) to ensure estimates align for a smoother process.

- Meet with the adjuster during the inspection.

- Handle most of the emails and calls with your adjuster.

- Be licensed, insured, and have great online reviews.

This process involves a lot of effort, so reward your contractor’s hard work by hiring them if your insurance approves the claim.

FINISHED WITH THE ROOFING INSURANCE FAQ AND STILL HAVE QUESTIONS? CONTACT ROOF MD TODAY!

A good roofer will guide you through the process and prioritize your needs. If you need more information about roofing insurance claims or storm damage, contact Roof MD today. Our experts are ready to help!

We’ll provide all the details and walk you through filing a claim. Schedule a FREE Roof Inspection and consultation below to get started!

Fill out a quick form, and we’ll contact you to set up your free roof inspection and answer your questions!

OR CALL US TOLL-FREE at 866-601-2408