The Homeowner’s Guide to Roof Insurance Adjusters

Navigating Roof Damage and Insurance Claims

Discovering property damage after a storm can be stressful. Your roof protects your home, and when it’s damaged, it disrupts everything. On top of worrying about repairs, you also need to handle insurance claims.

That’s where the insurance adjuster comes in—they assess the damage and determine your settlement. Understanding their role and what to expect can help you secure fair compensation. This guide covers everything from the adjuster’s job to the benefits of working with a professional roofing company.

Dealing with insurance companies can be tough, but with the right knowledge and support, you can navigate the insurance claims process and protect your interests. Let’s dive in!

Who Are Roof Insurance Adjusters?

When filing an insurance claim, an adjuster evaluates how much the insurance company should pay. They inspect the damage, determine the cause (like wind or hail), and estimate the cost to repair or replace your roof based on your policy. Their assessment decides your payout.

Who Does the Adjuster Work For?

Adjusters work for the insurance company, not for you. While their job is to assess claims fairly, their loyalty is to the insurer.

Here’s what they handle:

- Investigating the cause of the damage.

- Determining if your policy covers the damage.

- Estimating repair costs based on policy terms and industry standards.

- Managing claims efficiently while controlling costs for the insurer.

Insurance companies aim to minimize expenses, so adjusters often align with their financial goals. While this doesn’t mean they’ll shortchange you, their priorities might not match yours.

To protect yourself, consider working with an independent roofing contractor. They can guide you through the process and help ensure you get the settlement you deserve.

The Adjuster’s Eye: What They Look For on Your Damaged Roof

The Inspection Process

When an insurance adjuster inspects a damaged roof, they follow a detailed process that can impact your claim. They take photos, notes, and measurements to document the damage. Their main goal is to determine what caused the damage—hail, wind, or a fallen tree—and confirm it’s covered by your policy.

Common Roof Damage Adjusters Look For

Adjusters are experts at spotting damage, especially after storms. Here’s what they check for:

- Wind Damage: Missing shingles are an obvious sign, but they also look for cracked, curled, creased, or lifted shingles and broken seals that affect waterproofing.

- Hail Damage: Dents, bruises, and missing granules on shingles are clear signs. Adjusters also inspect gutters, flashing, and vents for dents.

- Debris Damage: Tree branches or debris can puncture or damage your roof during storms. This type of damage is often covered by insurance.

Beyond Visible Storm Damage

Adjusters also assess your roof’s overall condition, which can impact your claim:

- Granule Loss and Wear: Granules protect shingles from UV rays and weathering. Adjusters check for granules in gutters or bald spots to decide if the loss is storm-related or due to aging.

- Leaks and Water Damage: Ceiling stains, mold, damp insulation, or wood rot are serious issues. Adjusters trace leaks to see if they were caused by a covered event.

- Flashing and Sealant Issues: Adjusters check for missing, bent, or worn flashing and cracked sealants. Damage from impacts is usually covered, but wear and tear is not.

- Structural Integrity: Sagging decks or weakened beams can signal bigger problems, especially on older roofs.

The Impact of Roof Age, Condition, and Maintenance

Your roof’s condition before the damage plays a big role. Adjusters consider its age, materials, and maintenance. Common exclusions include:

- Pre-Existing Damage or Neglect: If your roof was already damaged or poorly maintained, insurers might reduce or deny your claim.

- Improper Installation: Damage caused by poor installation is considered a workmanship problem and isn’t covered.

A key challenge with roof claims is distinguishing “wear and tear” from “sudden, accidental damage.” Insurance covers unexpected events, like storms—not aging or neglect. Adjusters look for clues, such as fresh hail marks versus weathered cracks, or localized wind damage versus general aging.

Older roofs naturally show more wear, which can lower your claim due to depreciation. Disputes often arise—homeowners may think all damage is storm-related, while adjusters might blame age or pre-existing issues. In such cases, an independent roofing contractor can help argue the storm caused or worsened the damage.

Understanding how adjusters evaluate damage and your roof’s history can help you navigate the claims process.

The Claim Journey: What Adjusters Do from Start to Finish

How Adjusters Help with Your Roof Insurance Claim

Insurance adjusters guide your roof claim from filing to settlement. Here’s the process:

- Claim Assignment & Review: After filing, an adjuster reviews your claim and policy to determine coverage, deductibles, and limits.

- Contact and Scheduling: The adjuster reaches out to gather details and schedule a property inspection.

- On-Site Inspection: They assess roof damage, noting the cause, severity, and contributing factors, while taking photos and measurements.

- Estimation: After inspection, they estimate repair or replacement costs, detailing what’s needed and how much the insurer will pay.

- Report and Recommendation: The adjuster submits their findings and cost estimate to the insurer, recommending approval or denial of the claim.

- Decision & Settlement Offer: If approved, you’ll receive a settlement offer based on their report.

- Negotiation (if needed): If you or your contractor disagree with the findings, you can negotiate. The adjuster may explain or adjust their estimate during this process.

How to Prepare for the Adjuster’s Visit

A little preparation can streamline the claim process. Here’s how to get ready:

- Ensure Safety: Clear debris and mark hazards before the inspection.

- Document Damage: Take photos and videos of damage—inside and out—before doing temporary repairs.

- Gather Paperwork: Have your policy, past repair receipts, and warranties ready.

- Be Present: Attend the inspection, point out damage, and ask questions. Bringing a contractor can help.

- Ask Questions: Clarify findings and your coverage.

- Take Notes: Record what the adjuster examines, their comments, and any timelines or agreements.

- Get Contact Info: Ask for their contact details, the claim number, and an update timeline before they leave.

Staying involved ensures a thorough inspection. Adjusters manage multiple claims and have limited time, so proactive communication and documentation help highlight all damage, even minor issues, for a fairer settlement.

Your Best Defense: Why an Independent Roofing Company is Your Biggest Ally

Dealing with a roof insurance claim can be overwhelming, especially with insurance adjusters working for the insurer, not you. That’s why having a reliable, independent roofing company on your side is essential. They make sure your roof is repaired properly and fairly.

Leveling the Playing Field: Expertise on Your Side

Insurance adjusters know policies and claims inside out, but their main goal is to save the insurer money. Independent roofers, on the other hand, are experts in roof systems, damage assessment, and local repair costs. They advocate for your best interests, balancing the scales with clear, expert-backed claims.

A Roofer’s Inspection: The Second Opinion You Need

Many roofers offer free inspections, which can be invaluable before the adjuster arrives. They’re trained to spot damage others miss, including hidden issues. With detailed reports—often including photos or drone footage—they create a clear record of the damage.

Clear Estimates That Cover It All

Roofers do more than identify damage—they provide detailed, itemized estimates that account for local labor costs, high-quality materials, and code-compliant repairs. A skilled roofer can create accurate estimates using the adjuster program Xactimate and often identifies issues that adjusters might miss. This ensures your roof receives the thorough care it requires.

Holding Adjusters Accountable: Advocating for You

One major advantage of hiring an independent roofer is their ability to work directly with the adjuster. During inspections, they ensure:

- All damage is documented.

- Repairs and materials are clearly explained.

- Adjusters can’t downplay issues or skip repairs.

If something is overlooked, your roofer’s detailed inspection and estimate provide solid evidence. Experienced roofers know how to negotiate for a fair settlement.

Simplifying Policy Jargon (ACV vs. RCV)

Insurance policies can be confusing. While roofers aren’t legal experts, experienced ones understand terms like Actual Cash Value (ACV) and Replacement Cost Value (RCV):

- ACV (Actual Cash Value): Covers depreciated roof value, often not enough for full replacement.

- RCV (Replacement Cost Value): Covers full replacement costs, usually paid in two parts: ACV upfront and depreciation after repairs.

A skilled roofer ensures recoverable costs, like code upgrades, aren’t missed and guides you through the process so your paperwork is accurate.

Why Involve a Roofer Early?

Involving a roofer early ensures you’re not underpaid. Adjusters often provide conservative estimates that overlook local conditions or roof complexity. A roofer’s inspection—before or during the adjuster’s visit—documents all damage, even the subtle issues. Their report and estimate help you challenge low offers.

With a reliable roofing company on your side, your roof will be repaired correctly, without shortcuts. They advocate for fair coverage, keeping your home protected.

When You Disagree: Challenging an Adjuster’s Findings

You Can Push Back

If your adjuster’s findings or settlement feel unfair, you don’t have to accept it. Whether it’s too low or incomplete, the first offer is just the starting point.

Why Claims Get Denied or Underpaid

Roof damage claims are often denied or underpaid for reasons like:

- Wear and Tear: Blamed on age or normal wear, not a covered event.

- Pre-Existing Damage: Old issues are blamed for current problems.

- Poor Maintenance: Insurers claim neglect caused the damage.

- Improper Installation: Faulty installation isn’t usually covered.

- Policy Exclusions: Certain damage, like water issues, isn’t covered.

- Below Your Deductible: Repair costs are under your deductible limit.

- Lack of Proof: Not enough evidence links damage to a covered event.

- Late Filing: The claim missed policy or state deadlines.

What to Do if You Disagree

If you disagree with the adjuster’s decision:

- Review the Decision: Get the denial or settlement in writing and compare it with your policy and your roofer’s report.

- Talk to the Insurer: Explain why you disagree. Share evidence like photos, reports, and estimates. Stay professional but firm.

- Request a Re-Inspection: Ask for a second inspection with another adjuster. Bring all your evidence, including your contractor’s findings.

- Provide More Proof: Work with your contractor to provide additional details, such as cost breakdowns, building codes, or material specs, to strengthen your claim.

Next Steps if You’re Still Stuck

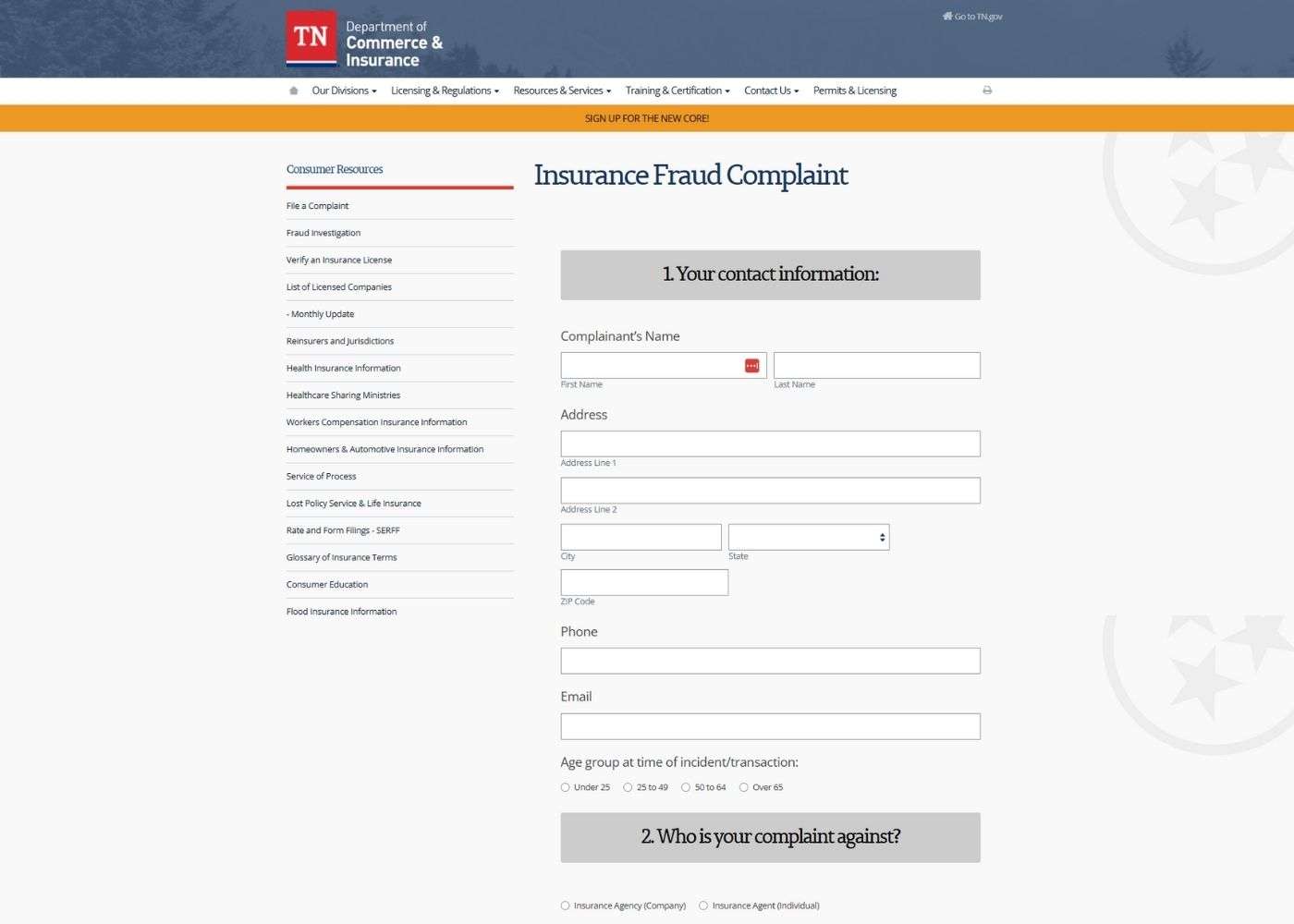

If you’ve tried everything and the issue isn’t resolved, here are your options:

- Hire a Public Adjuster: These licensed professionals work for you, not the insurance company. They interpret policies, document claims, and negotiate settlements. They usually take a percentage of your payout but can help with tough or undervalued claims.

- Mediation or Appraisal: Many policies offer alternative ways to settle disputes:

- Mediation: A neutral third party helps you and the insurer reach a settlement.

- Appraisal: For disputes about repair costs, both sides hire appraisers. If they disagree, a neutral umpire decides. Detailed contractor reports are essential for success.

- File a Complaint: If you think the insurer is being unfair, file a complaint with your state’s Department of Insurance (DOI). They can investigate and intervene if needed.

- Talk to an Attorney: For major or complex disputes—or if you believe the insurer is acting in bad faith—consult an attorney specializing in insurance claims. Legal action can take time and money but may be necessary to ensure fairness.

Dealing with a denial or low settlement offer can be overwhelming, especially with roof damage adding stress. But the process doesn’t have to end here. With strong documentation, contractor support, and persistence, you can push for a fair outcome. Don’t give up—your roof (and peace of mind) is worth it.

Key Takeaways: Navigating the Roof Claim Process

Handling a roof insurance claim takes focus, knowledge, and persistence. These tips can help improve your chances of a fair settlement and ensure your home stays protected:

- The Adjuster Works for the Insurer: Adjusters evaluate claims based on the policy and company guidelines, not necessarily in your best interest.

- Knowledge is Power: Understand your policy, the adjuster’s role, and the claims process to stay ahead.

- Document Everything: Take photos, videos, and notes. Combine these with professional assessments from a trusted roofer for strong evidence.

- Independent Roofers Matter: Reputable roofers provide:

- Detailed assessments, including damage adjusters might overlook.

- Accurate estimates based on fair market rates.

- Advocacy for fair settlements.

- Help navigating confusing insurance terms and processes.

- Stay Proactive: Be involved during inspections, ask questions, and keep detailed records of all communications.

- Challenge When Necessary: If the adjuster’s findings or settlement seem unfair, dispute them and know your options for escalation.

Roof insurance claims can be complicated, but with the right preparation and professional help, they’re manageable. A fair settlement isn’t just about repairs—it protects your home’s long-term safety and value.

Poor repairs can lead to leaks, structural damage, and mold, and future issues from bad fixes may not be covered. Insurers might even refuse to renew policies on poorly maintained roofs. Pursuing a fair settlement with the help of an independent roofer is an investment in your home’s health, homeowners insurance coverage, and peace of mind.