Why You Should Avoid Letting a Roofer Waive Your Deductible

After a storm damages your roof, it’s natural to feel stressed and eager to get repairs done quickly. When a roofer offers to waive your deductible on a roof insurance claim, it may seem like an easy way to save money. However, what appears to be a good deal can have serious consequences.

Allowing a roofer to waive your deductible is not only illegal but also risky. It could end up costing you significantly more than you anticipate. Here are the key reasons why you should decline such an offer.

1. It’s Fraud and It’s Illegal

When you file a claim with your homeowners insurance for roof damage, paying your deductible is a contractual requirement. Roofers who promise to “waive” your deductible often do so by falsifying invoices or inflating costs to create the appearance that you’ve paid.

This constitutes insurance fraud. Even if the roofer is the one committing the act, agreeing to their offer makes you complicit. In many states, this practice is explicitly prohibited by law, and enforcement agencies take it seriously. Penalties can include fines, lawsuits, or even criminal charges.

It’s important to understand that ignorance isn’t a valid defense. While it may seem like the roofer is offering you a favor, agreeing to their proposal directly involves you in fraudulent activity.

2. Your Insurance Claim Could Be Denied

If your insurance company detects any fraudulent activity, they have the right to deny your claim entirely. This leaves you responsible for covering the full cost of roof repairs or replacement on your own—a far greater expense than the deductible you were attempting to avoid.

Fraud can also have long-term consequences for your insurance coverage. Your provider may choose to cancel your policy, leaving you unprotected. Additionally, a history of fraud on your record could make it more difficult—and more expensive—to secure new coverage, as many insurers avoid high-risk clients.

3. You Risk Compromising the Quality of Your Roof

Contractors who offer to waive deductibles often resort to cutting corners to compensate for the financial loss. This practice is very common in traveling roofers and “Storm Chasers” who prey on recent storms to get a quick insurance claim. Cutting corners like this can result in subpar workmanship, the use of inferior materials, and rushed repairs.

The potential consequences include:

- Leaks and water damage: Poor-quality repairs may leave your roof vulnerable to future storms, leading to costly and avoidable issues.

- Reduced roof lifespan: Low-grade materials can significantly compromise the durability of your roof.

- Expensive future repairs: Rectifying substandard work often costs far more than hiring a reputable contractor from the outset.

Ultimately, trying to save money by agreeing to questionable practices could lead to significantly higher expenses and long-term challenges.

4. You Could Be Held Responsible

The takeaway? Avoid contractors who offer to waive your deductible. Instead, focus on working with licensed, reputable professionals who adhere to industry standards and legal requirements. This ensures your roof is repaired correctly, your insurance claim is handled ethically, and you are safeguarded against unnecessary risks.

Even if you are not directly involved in falsifying invoices or inflating costs, agreeing to a waived deductible makes you complicit in insurance fraud. Many homeowners are unaware that accepting this type of deal could expose them to legal liability.

If fraud is uncovered, you could face investigations, fines, or even lawsuits. Claiming ignorance of the arrangement’s details will not protect you in legal proceedings. By agreeing to waive your deductible, you are putting your finances, reputation, and peace of mind in jeopardy.

5. The Best Roofers Operate with Integrity

Reputable roofing companies do not rely on unethical tactics to secure business. Offering to waive a deductible is often a clear red flag, signaling that the contractor may not be trustworthy.

A reliable roofer will:

- Be transparent about pricing.

- Comply with all insurance regulations.

- Use high-quality materials.

- Focus on delivering superior craftsmanship.

- Provide warranties and guarantees to stand behind their work.

If a contractor is willing to break the law to win your business, consider what other shortcuts they might take. Could they be skipping safety inspections or using unqualified labor? The risks simply outweigh the benefits.

6. What to Do if a Roofer Offers to Waive Your Deductible

If a contractor proposes waiving your deductible, it is a clear indication that they are not someone to trust with the integrity of your roof. Here’s how to respond:

✅ Decline their services: Do not engage with contractors who suggest unlawful practices.

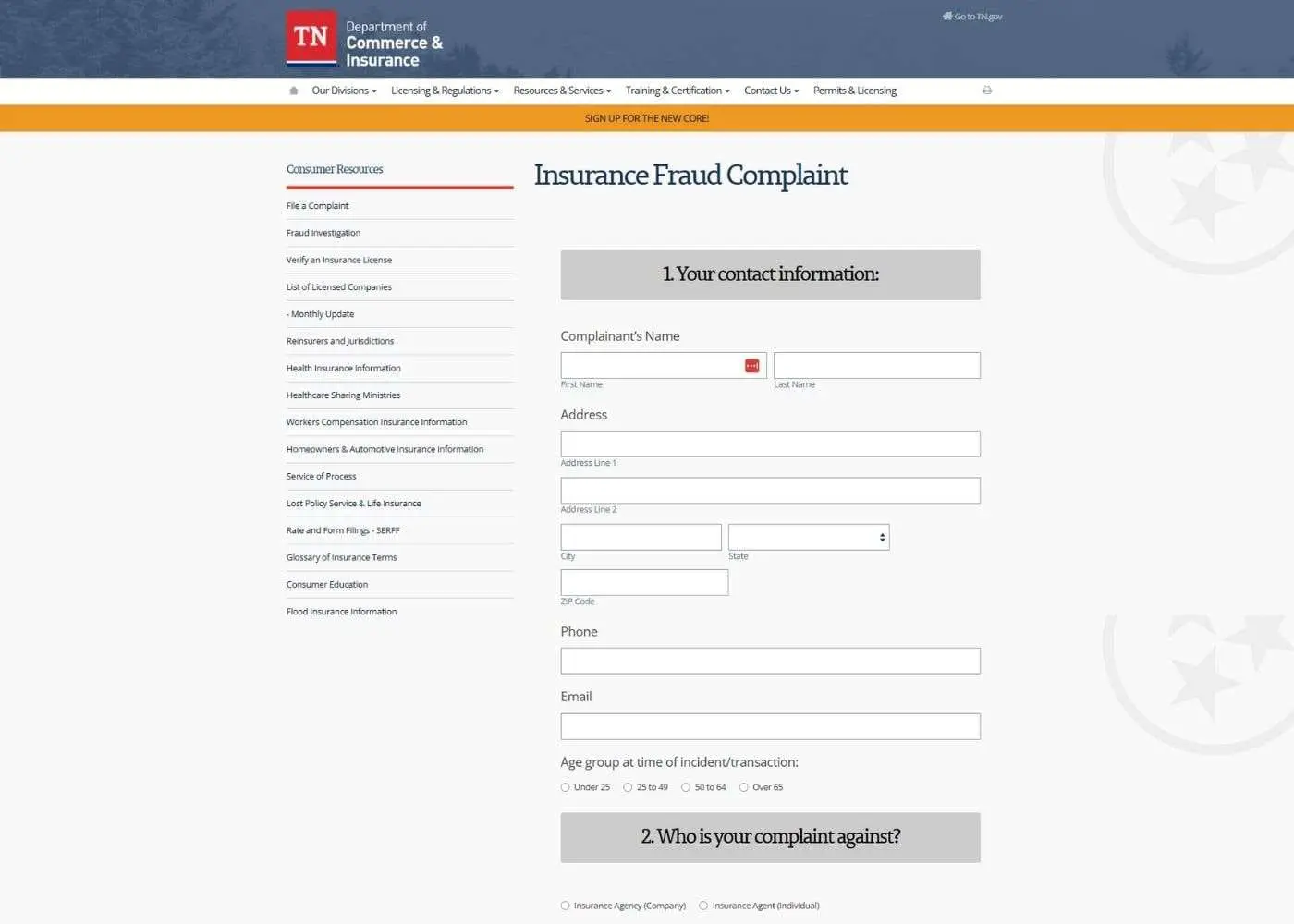

✅ Report their behavior: Notify your state’s insurance fraud department to hold them accountable.

✅ Choose reputable contractors: Seek licensed, insured roofers with strong reviews and a proven track record.

✅ Request clear documentation: Always obtain written contracts outlining pricing and the scope of work before any repairs begin.

By taking these steps, you not only protect your home and finances but also promote ethical practices within the roofing industry.

If you’re in Tennessee, then you can report the shady roofer via the Department of Commerce and Insurance.

The Bottom Line

Your roof is one of the most significant investments in your home. Don’t put it at risk by working with contractors who cut corners or engage in unlawful practices. While waiving a deductible may appear to save money, the potential legal, financial, and structural consequences far outweigh any perceived benefits. Choose to work with honest, reputable roofers who adhere to the law and prioritize quality craftsmanship. They should walk you through the entire claim process, step by step and handle everything the right way.

Not only will you receive a durable, long-lasting roof, but you’ll also gain peace of mind knowing your home, finances, and future are safeguarded. Paying your deductible is a small price for the security and integrity of your investment.

If you’re located in Tennessee or Georgia, Roof MD is here to help with all your roofing needs. As an Owens Corning Platinum Preferred Contractor, we’re proud to use only the highest-quality materials and warranties to ensure your home is protected for years to come. Our team is dedicated to providing honest, straightforward guidance—no pressure, no confusing deductible nonsense, and no sketchy replacement processes. We believe in transparency every step of the way.

Whether your roof has been damaged by storms, wear and tear, or other unforeseen issues, we’re here to help you navigate the process with ease. Schedule a free inspection today, and let us provide a thorough, professional evaluation to determine if your roof qualifies for replacement through insurance. With Roof MD, you can rest assured knowing your home is in the hands of experts who truly care.